36+ What size mortgage can i qualify for

Using the 36 rule Martins monthly housing budget is around 14000. That means your mortgage payment should be a maximum of 1120 28 percent of 4000 and your other debts should add up to no more than 1440 each month 36 percent of 4000.

3m Cubitron Cheap Sale Ii Fibre Disc 987c 4 1 2 25 X Pie 36 7 In 8

Our fixed-rate mortgage calculator can help you figure out if a 15-year or 30-year mortgage is a better match for both your current financial situation and your future earnings.

. Subtract your other debts including your car payment your student loan payment and other debt payments from this amount to determine the maximum amount you can spend on your monthly mortgage payment. Now you have your debt ratios. Theres good news for borrowers struggling to qualify for a mortgage to buy a more expensive home in 2022.

As a general rule to qualify for a mortgage your DTI ratio should not exceed 36 of your gross monthly income. HUD requires different amounts of residual income based on family size and where the property is located due to cost of living differences. Including your mortgage to be more than 36 percent of your gross monthly income.

This is the maximum amount you can pay toward debts each month. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your.

Government-Insured Veterans Affairs VA Loans. Debt-to-income ratio requirements depend on the size of your down payment and your credit score. Most of the land mass of the nation.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. What do you do. Assuming a 30-year mortgage that amount of 630000 can then be used to gradually pay for his mortgage over the next 360 months.

Get pre-approved with a lender today for exact numbers on what you can afford. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit.

FHA loans allow a FICO score as low as 500 to qualify for a 10 down payment and as low as 580 to qualify for a 35 down payment. Doing so makes it easy to see how changes in costs and mortgage rates impact the home you can afford. Updated 2022 to reflect new residual income guidelines.

Interest rates for a 30-year fixed-rate FHA loan are now hovering around 45 up from just under 3 at the beginning of the year. This mortgage finances the entire propertys cost which makes an appealing option. Generally it should be no more than 28 percent of your gross monthly income for the front ratio and 36 percent for the back but the guidelines vary widely.

Determining your monthly mortgage payment based on your other debts is a bit more complicated. Fannie Mae allows a DTI up to 45 with a 660 FICO and at least 25 down. You have a lot of loan options as a homebuyer but fixed-rate mortgages are the most commonly used.

However as a drawback expect it to come with a much higher interest rate. Higher-cost areas get even more bang for the. August 30 2022 By Michael Branson 36 comments.

Multiply your annual salary by 036 percent then divide the total by 12. While millennials are well known for taking out large amounts of student loans these are actually not their main source of non-mortgage personal debt but rather credit card debt. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. To qualify for a reverse mortgage you must meet these minimum income requirements. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Before sharing sensitive information make sure youre on a federal government site. Lenders will also review other aspects of your finances including the following. The gov means its official.

According to a 2019 Harris poll the average non-mortgage personal debt of millennials was US27900 with credit card debt representing the top source at 25. If you can qualify for. Mortgage loan basics Basic concepts and legal regulation.

Rental price 70 per night. Mortgage Required Income Calculator FAQs. Length of loan term.

While certain homebuyers can qualify for little or no down payment through VA loans or other 0 down payment programs most homeowners who dont have a large enough down payment will have to pay the extra expense for PMI. For today September 12th 2022 the current average mortgage rate for a 30-year fixed-rate mortgage is 5668 the average rate for a 15-year fixed-rate mortgage is 4967 the average rate for a. Martin can make it happen.

While determining mortgage size with a calculator is an essential step it wont be as accurate as talking to a lender. Federal government websites often end in gov or mil. A high income borrower might be able to have ratios closer to 40 percent and 50 percent.

It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. Opponents want the city to kill any future funding for citys plan to recycle highly treated wastewater to bolster water supply. Multiply your annual salary by 036 percent then divide the total by 12.

While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. For example some experts say you should spend no more than 2x to 25x your gross annual income on a mortgage so if you earn 60000 per year the mortgage size should be at most 150000.

Current FHA loan rate trends. The size of your down payment. FHA loan limits increased to 420680 for most parts of the country.

That would give him 1750 a month to put toward a housing payment.

1

36 Best Company Introduction Powerpoint Template Downl Https Www Behance N Business Powerpoint Templates Powerpoint Templates Creative Powerpoint Templates

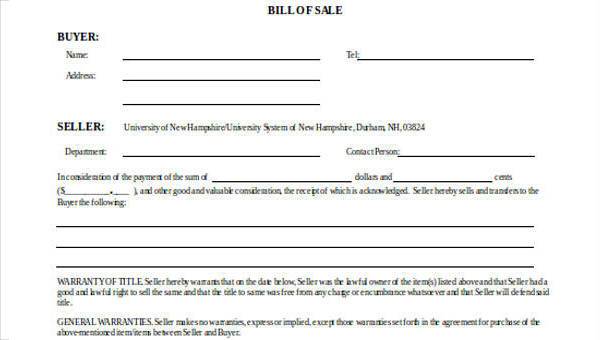

Free 36 Bill Of Sale Forms In Ms Word

3

36 Pinehurst Dr 36 East Haven Ct 06513 Mls 170520366 Redfin

36 Best Free Number Fonts For Graphic Designer 2019 Number Fonts Numbers Font Best Number Fonts

36 Easy Places To Get A Cheap Or Free Notary In 2021 Frugal Living Coupons And Free Stuff Frugal Living Coupons And Free Stuff

36 Awesome House Plan Ideas For Different Areas Engineering Discoveries Building Plans House Create House Plans Diy House Plans

36 Awesome House Plan Ideas For Different Areas Engineering Discoveries In 2022 Little House Plans House Plans Model House Plan

Blue Business Year Report Powerpoint Template Pcslide Com Powerpoint Templates Presen Powerpoint Presentation Design Powerpoint Templates Powerpoint Design

Trading Card Retro Style Baseball Card Template Trading Card Template Cards

1

36 Acres Cottonwood Hills Subdivision Missouri Valley Ia 51555 For Sale Mls 22 876 Re Max

1

36 Creative House Plan Ideas For Different Areas In 2022 House Plans Budget House Plans House Layout Plans

Loan Paid In Full Letter Template Letter Templates Lettering Ms Word

36 Signal Hill Road Wilton Ct 06897 Compass